Public Service Loan Forgiveness Limited Waiver Opportunity

Now, for a limited period of time, borrowers may receive credit for past payments made ... Read more

Written by: SDN Staff

Published on: October 11, 2021

Now, for a limited period of time, borrowers may receive credit for past payments made ... Read more

Written by: SDN Staff

Published on: October 11, 2021

We never fully understood the effort healthcare professionals put into their services before the COVID-19. ... Read more

Written by: Samira Valiyeva

Published on: August 23, 2021

If you are struggling to repay your student loans, you may have several options to ... Read more

Written by: Ernest Atta Adjei

Published on: June 21, 2021

Congratulations to all the new doctors! You are all going to save a lot of ... Read more

Written by: Patricia Sanders

Published on: June 14, 2021

Updated October 21, 2021. When most people think of the Student Doctor Network, they think ... Read more

Written by: Student Doctor Network

Published on: February 6, 2020

You’ve done it. You killed undergrad, conquered the MCAT and finally received a fateful acceptance ... Read more

Written by: Erin Wildermuth

Published on: November 25, 2019

Save time and money on your student loans Congratulations, new veterinary doctors! It’s time to ... Read more

Written by: Tony Bartels

Published on: May 27, 2019

It’s a fact of life: you need money to pay expenses that allow you to ... Read more

Written by: AAMC Staff

Published on: August 9, 2018

Medical training is a significant investment for both you and your spouse. It’s an investment ... Read more

Written by: Amy Rakowczyk

Published on: June 7, 2018

Unless you’re one of those people who wins every scholarship you apply for, you’ve likely ... Read more

Written by: Dave Rathmanner

Published on: April 10, 2018

Young physicians have some of the highest mortgage underwriting decline rates of any professional seeking ... Read more

Written by: Josh Mettle

Published on: March 15, 2018

If you are having difficulty making your federal student loan payments, the worst thing you ... Read more

Written by: Institute of Student Loan Advisors

Published on: February 28, 2018

You got into medical school! Now how do you pay for it? You already sold ... Read more

Written by: Matt Sutton

Published on: February 27, 2018

Updated September 2, 2021. The article was updated to correct minor grammatical errors and to ... Read more

Written by: Andrew Josuweit

Published on: July 17, 2017

While student loans are a necessary financial tool for most of today’s future doctors, the ... Read more

Written by: Maricel Tabalba

Published on: May 1, 2017

Aside from long hours and lots of studying, the other guarantee in medical school is ... Read more

Written by: Amy Rakowczyk

Published on: February 2, 2017

Consider these three questions. First, what is a loan? Second, how is it typically is ... Read more

Written by: Tae Kwan

Published on: October 5, 2016

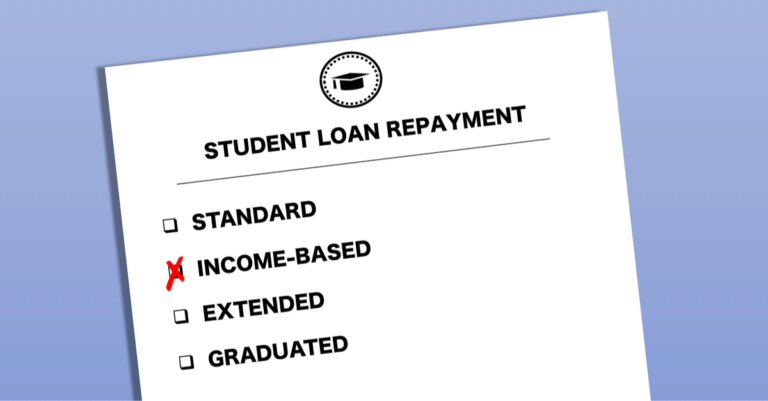

With loan debt for students in graduate health professions rising exponentially, the conversation around choosing ... Read more

Written by: Timothy Ulbrich

Published on: May 31, 2016

I remember the sheer joy of ripping open the letter that granted me a medical ... Read more

Written by: Adelle

Published on: March 14, 2016