Many medical students cheerfully expect to be earning a generous income as they begin their medical practice. But while it is true that that, according to the Medical Economics website that in 2014, 7 of the 10 top-paying jobs were in the medical profession, the issue of course is far more complicated than that. The American Association of Medical Colleges estimates that a four-year medical education at a private school today will cost around $278,455 dollars while a public one runs only slightly below that at $208,868. And the average medical student will be around $180,000 in debt at the time of their graduation. Around 20% will have debt in excess of $250,000.

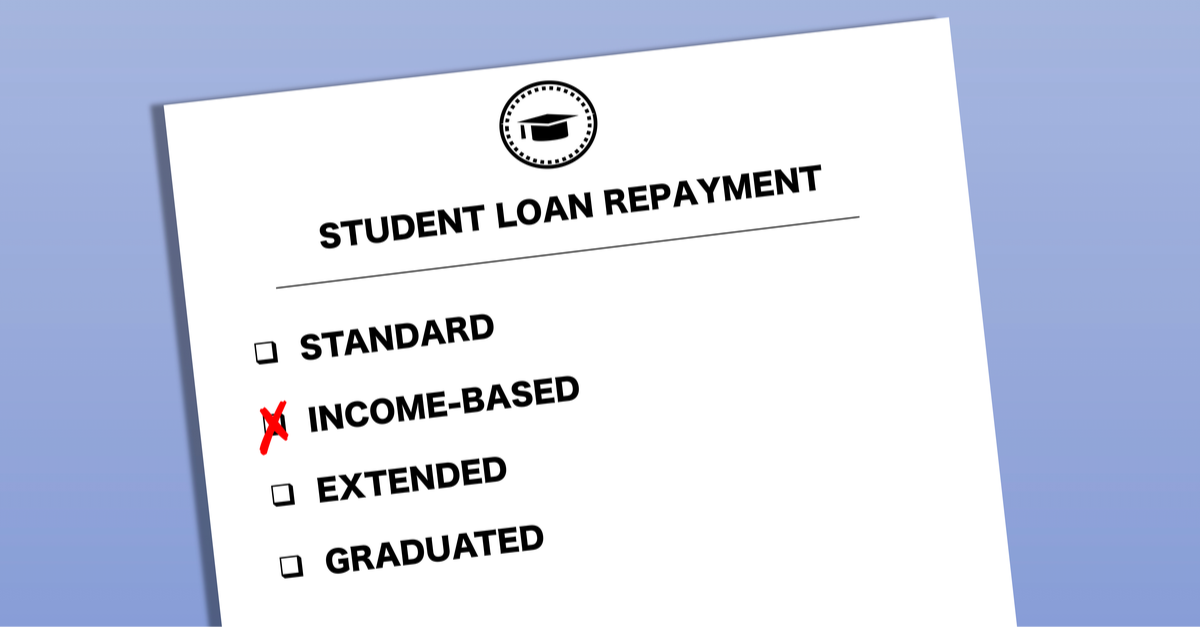

These numbers can seem staggering. Fortunately, there are programs available to medical students which not only get them out from this monumental debt, but help underserved communities across the country and improve access to quality medical care for some very vulnerable patient populations.

Read more